Payday Loan

Without the Fees!

Payday Loan With No Upfront Fees

Please complete the application form, and we will pass your details (in real time) to our direct lender partners, and our other trusted partners, who may be able to facilitate your application for a short term loan or other related product.

How it works

1. Apply

Complete our online application form to see if you meet the initial criteria for quick cash. If you do, underwriters will personally assess your application for credit to see how they can help.

2. Get Same Day Funding

After receiving your completed application, and on loan approval, our direct lender partners can offer same day funding. Funds are paid directly into your bank account.

3. Flexible Repayment

Our direct lender partners practice responsible lending and in turn operate a flexible payment structure.

THLD are a broker not a lender

We work with direct lender partners.

Why choose Us

We work with payday loan instalment direct lender partners

Settle at Any Time

Our direct lender partners allow you to settle at any time without any penalties. If approved, your payday loan will be set up for payment over multiple months but you can contact the lender at any time for a settlement balance. This allows you to only pay for the time you borrow.

Fast Easy Acceptance

As we work with direct lender partners, we can help a variety of people in many different circumstances. The underwriters assess each application for credit to see if they can help and if you meet their initial criteria

Choose THL Direct

We are fully licensed and authorised by the FCA as a loan broker. We work with payday loan direct lender partners and their payday instalment loans are set up for payments spread across multiple paydays.

Want Your Loan Over a Longer Period?

We work with direct lender partners who offer loans from 2 to 24 months.

Paid Weekly?

We understand that not everyone has a monthly payday or finds a big monthly payment easy to budget. To help with this, we partner with lenders who take being paid weekly into account in both the decision making and loan repayment processes.

Clear and Transparent

Our direct lender partners allow you to be in control of your short-term loan. You decide how much to borrow and the dates to pay the loan back. We pride ourselves in working with direct lenders who have transparent lending processes.

FAQ About Payday Loans

Payday loans without the fees

Can I Have a Loan?

You don’t need to have a perfect credit rating; our direct lender partners carry out many checks to make sure the loan is affordable and they are lending responsibly.

How do I get my Loan?

You can apply for your short-term loan online.

Our application form is only available online, so you can complete the form when it best suits you. We’ll ask the usual personal details, about your job and your income and outgoings

How long can I have my loan over?

We work with direct lender partners who offer loans from 2 months to 24 months. Payday loans or short-term loan can be paid back at anytime within the term with no penalty.

How Much Can I Borrow?

You can borrow between £150 to £3000. We’ll always advise you how much it will cost before you decide to proceed.

What Purpose Can the Loan be for?

Our short-term loans are for any unexpected expenses that may arise, from your car breaking down to boiler repairs.

Paying your loan back

Once you have agreed to repay the amount payable on the agreed repayment dates, as per your loan agreement. The lender will collect these payments.

Failure to get your loan repayments back on track will result in:

- Possible legal action

If your loan goes into arrears the lender will work with you to find the best and affordable solution to get you back on track.

Defaulting on your payday or short-term loan

If you’re having Difficulties making a payment, please contact your lender as soon as possible to go over your payment options. They are there to help you and work hard to make every effort to reach an acceptable solution with you.

If you do not call or email your lender and they are unable to take payment over a reasonable period of time, your account may be passed to a debt collection company.

If you do not repay your loan it may also mean that Credit Reference Agencies (CRAs) will record the outstanding debt. This information may be supplied to other organisations by CRAs and Fraud Protection Agencies (FPAs). Records may remain on file for six years after they are closed, whether settled by you or defaulted.

Unfortunately, by defaulting on your payday or short-term loan it may negatively impact your credit rating. If you are unable to keep to the terms of your short-term loan agreement, you MUST contact your lender to work with you and help clear your loan balance in an affordable and manageable way.

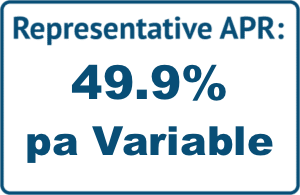

Representative example: £1200 for 18 months at £90.46 per month. Total amount repayable of £1628.28. Interest: £428.28. Interest rate: 49.9% pa (variable). 49.9% APR Representative (variable). Rates from 45.3% APR to max 1575% APR - your APR will be based on your personal circumstances.